Financial Adviser Services

Delivering better outcomes for advisers and investors.

Delivering better outcomes for advisers and investors.

We are one of Australia’s leading fund managers of property-based investments and, for over 15 years, we’ve been supporting financial advisers build wealth for their clients. With a track-record of delivering on investment outcomes, backed by a rigorous governance and compliance framework, we offer an alternative option to your clients seeking competitive income, whilst managing risk.

![]() Personalised Service

Personalised Service

Our locally based Distribution and Investor Relations teams are easily contactable and available to help advisers and investors with questions, resources and support.

![]() Ease and access

Ease and access

Our products are available on multiple platforms, including Macquarie Wrap, Netwealth and Hub24. They are also available for direct investment via the Adviser Portal.

![]()

Risk management

High standards of corporate governance and compliance ensures an appropriate balance of risk management and investment performance.

![]() Track record

Track record

While past performance is not a reliable indicator of future performance we have, to date, had a successful track record of paying regular distributions to investors in Trilogy Funds products.

![]()

Strong ratings

SQM Research has rated each of Trilogy’s flagship products with a 4-star rating, and the Trilogy Monthly Income Trust and Trilogy Enhanced Income Fund have both achieved Very Strong ratings from Foresight Analytics.

![]() Diversification

Diversification

Trilogy Funds’ income funds offer advisers alternative options to diversify their clients’ portfolios with property or fixed income based investments.

![]() Experience

Experience

Trilogy Funds was established in 2004 when Philip Ryan joined with Rodger Bacon and John Barry, following their success as Directors of Challenger Limited. Our co-founders have decades of experience and continue to play an active role in the business. They are supported by a team of highly experienced and talented financial and property specialists.

Your client relationships are as valuable to you, as our adviser relationships are to us. That’s why we have a dedicated team that provides you the support you need, when you need it.

We aim to provide streamlined processes, personalised service and access to tools and resources, that will support advisers in providing an enhanced experience to their client.

Get in touch with one of our dedicated Distribution team members for an initial discussion about our investment options and adviser services and discover for yourself how Trilogy Funds can help deliver better outcomes for you and your clients.

A diversified income fund, with access to money in 30 days.

An income-focused pooled mortgage trust, offering competitive monthly income and portfolio diversity.

LEARN MORE

An industrial property trust designed to provide income and opportunity for long-term capital growth.

LEARN MORE

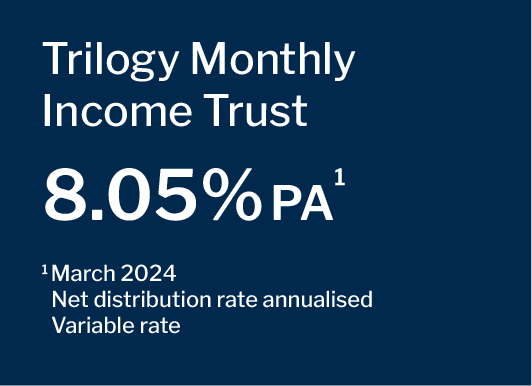

For latest rates and further detail, download the Trilogy Monthly Income Trust Investment Report.

View latest investment report

Platform availability

The Trilogy Monthly Income Trust (Trust) is a pooled mortgage investment that provides investors with exposure to returns available through loans secured by first registered mortgages over Australian property. The Trust finances a diverse range of property developments in the residential, commercial, industrial and retail sectors across the eastern seaboard of Australia. This structure provides a high level of diversification including geographic, borrower and lifecycle diversification amongst the array of loans secured by first mortgages.

*While unit price is fixed, capital losses can occur in circumstances where an asset of the Trust incurs a capital loss. Past performance is not a reliable indicator of future performance.

**Subject to the terms of the PDS.

^See the PDS and TMD for details.

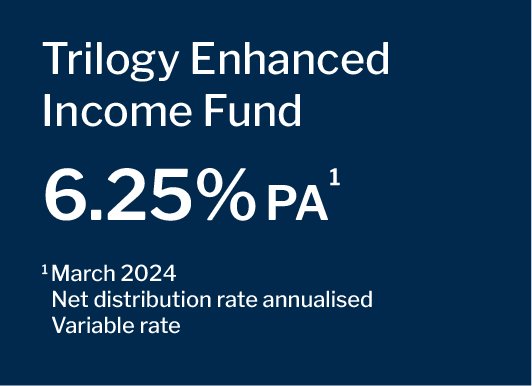

For latest rates and further detail on the Trilogy Enhanced Income Fund view our latest investment report.

View latest investment report

Platform availability

The Trilogy Enhanced Income Fund (Fund) invests directly and indirectly in a portfolio of cash, fixed-interest investments and other financial assets, with returns enhanced via exposure to the Trilogy Monthly Income Trust. Our dedicated in-house Treasury team proactively manages the fund by choosing ‘best in breed’ investments and closely monitors the Funds’ risks, liquidity and pricing. The target benchmark for the Fund is the Official Cash Rate plus 1.50% per annum, assuming reinvestment of distributions.

*While unit price is fixed, capital losses can occur in circumstances where an asset of the Trust incurs a capital loss. Past performance is not a reliable indicator of future performance.

**Subject to the terms of the PDS.

^See the PDS and TMD for details.

For latest rates and further detail on the Trilogy Industrial Property Trust, view our latest investment report

Platform availability

The Trilogy Industrial Property Trust (Industrial Trust) aims to build a diverse portfolio of industrial properties located in key Australian regional and metropolitan precincts. The Industrial Trust targets industrial properties that have the potential to provide investors with long-term cashflows and could offer the opportunity of value-add. This could include tenant-led expansion, refurbishment, and improvement works. The Trust will also consider development opportunities, brining fresh stock to the portfolio and enabling the Trust to secure long-term leases with new tenants.

*Subject to terms of the PDS.

^See the PDS and TMD for details.

We’ve created short videos for each of our products which are a great tool to use with clients, providing them with an understanding of how each of our products work.

|

Trilogy Enhanced |

Trilogy Monthly |

Trilogy Industrial |

|

|

Distribution Manager

QLD, SA, TAS

Distribution Manager

NSW

t 02 8028 2822

m 0434 552 298

e m.felsman@trilogyfunds.com.au