Creating an investment portfolio, financial planning and seeking professional advice from a licensed financial adviser plays an important role in building wealth and achieving financial stability.

Aside from that, there’s something to be said for the investment and money management mantras passed on from experienced investors, such as Warren Buffet and Benjamin Franklin, when it comes to achieving your financial goals.

In this article, we discuss four overarching rules for financial success from these investment veterans. These rules can help to ensure that your savings are working hard as part of a balanced portfolio that provides an attractive return, within your desired time-frames and tolerance for risk.

It’s worth pointing out that as each individual’s investment portfolio is exactly that – individual. How you implement an investment strategy will differ according to your personal goals and circumstances, meaning seeking professional financial advice is essential before making an investment decision.

1. Think long term

“If you want a better return on your investment, you need to learn to buy stock and forget about it”. – Warren Buffet

When asked on his 87th birthday for his best piece of investment advice [1], Buffet outlined a number of investment tips, one of which was to develop a buy-and-hold mentality.

Buffet said investors should hold onto their assets for decades, not days.

Why? When you buy low – for less than what the stock or asset is worth – the price will eventually increase to meet its intrinsic value. And, if you invest wisely, the value of that stock or asset will increase and compound exponentially – so the longer you hold onto it, the more its value should in theory, grow.

If you’re looking into a growth investment such as property for example, you would generally hold onto the asset over a longer period of time.

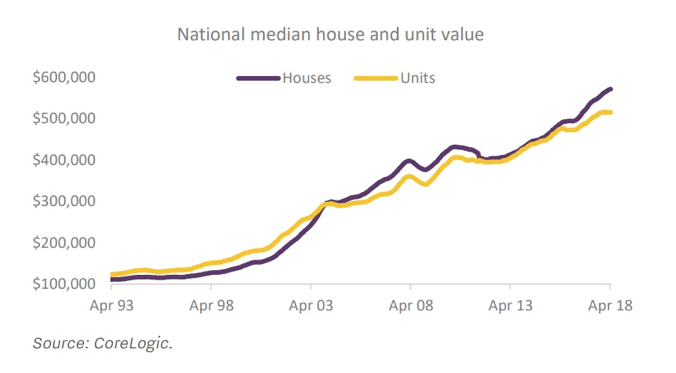

Just look at the growth within Australia’s housing market over the past 25 years. According to CoreLogic figures, the median house value nationally has risen by 412%, or $459,900. That means the capital gain over the past 25 years equates to an annual growth rate of 6.8%.

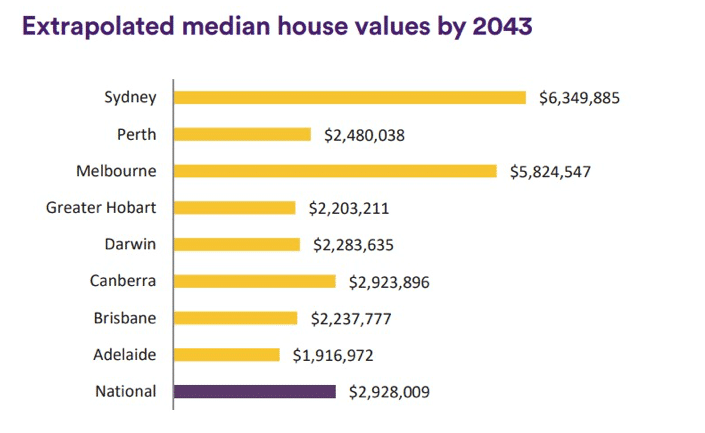

While past performance isn’t an indicator of future performance, if property prices were to rise at the same rate as the past twenty-five years, Australia’s median house value would reach $2.9 million by 2043.

Source: CoreLogic

When it comes to investment in equities, however, that buy-and-hold mentality can be difficult for some. For those who stock-watch, it can be all too easy to sell at the first sign of downturn instead of waiting out market volatility and any potential future value on that stock would be lost on an early sale.

2. Minimise expenses

As Benjamin Franklin so succinctly put, “in this world nothing can be said to be certain, except death and taxes”.

While taxes are inescapable, legally reducing the amount of tax you pay can play a vital role in successful wealth creation.

There are three main ways you can be conscious of your tax and work to minimise your bill however, it’s best seek advice from a qualified tax accountant or financial adviser before making a decision.

- Structure your investments to legally reduce your tax payable;

- Choose tax-effective investment strategies; and

- Buy and hold good quality assets so you don’t trigger capital gains tax.

3. Invest in assets you understand

Successful asset management often comes down to investing in assets you understand like the back of your hand. Building an investment portfolio filled with assets you don’t understand is something like investing blind. If you don’t understand how they work, how can you try to predict what they may do in the future?

If you were to take over a business, say a café in the Brisbane CBD, you wouldn’t invest blindly. You’d do research, finding out about the competition, its past performance, its suppliers, opportunities to diversify and expand and so on. You’d find out enough about the business, so you understood it and its chances of success.

The same applies to investing in shares, property, and managed funds. Back to Buffet. Buffet cautions that while you should never invest in businesses you don’t fully understand, you shouldn’t waste too much time trying to make yourself understand.

If it takes more than 10 minutes to understand how the company makes money and the main drivers that impact its industry, Buffet says it’s time to move on to the next option [2].

4. Don’t put all your eggs in one basket

A successful investor will often tell you diversification is the key to minimising potential losses while maximising potential gains.

One of the most common mistakes an investor can make is investing everything in a single asset or one asset class. This can often be a problem with property investment, as the costs to invest are so high.

By creating a diversified portfolio, it may be easier to ride out market downturns on any one particular asset, as there are other investments held within the portfolio that should work to balance out the loss.

Looking for more on managing your investment portfolio? Take a look inside Trilogy’s Managing Director’s investment strategy or check out this podcast with Nestegg.com.au on ways you can manage investment risk.

The material on this website is intended only to provide a summary and general overview on matters of interest. Trilogy is only licensed to provide general financial product advice on its own products and does not consider your objectives, financial situation or needs when providing any information or advice. You should consider whether the advice is suitable for you and your personal circumstances and we recommend that you seek personal financial product advice on your objectives, financial situation or needs and obtain and read the relevant product disclosure statement before making any investment decision.

[1] https://vintagevalueinvesting.com/8-investment-tips-for-beginners-from-warren-buffett/

[2] https://vintagevalueinvesting.com/8-investment-tips-for-beginners-from-warren-buffett/