Are you looking to invest with Trilogy, but not sure which product is best suited to you?

Our investment options aim to provide income-focused solutions, designed to help you achieve your financial goals. However, it can be difficult to understand the nuances of each product and make an informed decision about which product is best suited for you.

So, what are the differences between Trilogy’s investment options?

While the most appropriate investment option for you depends on your personal portfolio, financial goals and risk tolerance, there are a few key factors you should consider.

Read on as we discuss the key features of our two flagship income funds, the Trilogy Enhanced Income Fund and the Trilogy Monthly Income Trust.

The Trilogy Enhanced Income Fund

The Trilogy Enhanced Income Fund (Fund) is a diversified income fund.

The Fund invests approximately 65% of investor funds into cash, fixed-interest assets, and other financial assets. These may include a range of short to medium term bank deposits, bills of exchange, promissory notes, bonds, fixed or floating rate debt securities as well as income securities.

To enhance returns, approximately 35% of the portfolio is invested in the Trilogy Monthly Income Trust (Trust).

Source of distribution income

The distributions paid to investors are derived from returns from these cash, fixed interest, and other financial asset investments, as well as from the allocation in the Trilogy Monthly Income Trust.

Key features of the Fund

The Fund aims to provide investors with:

- a ‘defensive’ investment

- exposure to various fixed income debt instruments

- returns enhanced by exposure to the Australian property market

- regular income, rather than capital growth

- portfolio diversification

- professional management

- active investment risk management, and;

- the ability to access to their money in 30 days.

Investors in the Trilogy Enhanced Income Fund include individuals, self-managed super funds, and wholesale investors across all age groups.

Risk

The Fund is comprised of `typically ‘defensive’ assets, which means they carry lower risk than growth asset classes but tend to generate lower returns.

The Fund is indirectly exposed to construction risks via its allocation in the Trilogy Monthly Income Trust.

Our specialist investment team manages risk in the Fund by choosing ‘best in breed’ investments, actively managing the assets and allocations within the portfolio, as well as monitoring risks, liquidity, and pricing. Learn how we choose investment options and manage risk in the Trilogy Enhanced Income Fund.

Liquidity

Cash, fixed interest, and other financial assets included in the Trilogy Enhanced Income Fund are considered to have high liquidity as they can readily be converted to cash or other assets. As a result, the Fund aims to provide you with access to your money within 30 days of processing a withdrawal request.

The Fund’s performance

The Fund aims to pay a benchmark distribution rate of the Official Cash Rate plus 1.5% and provide competitive returns through any period of the volatile economic cycle.

As at 31 May 2021, the Trust has delivered the below historical average net distribution rates.

| May 2021 distribution rate | 3 months | 1 year | Since inception in 2017 |

| 3.04% PA* | 3.14% PA* | 3.21 % PA* | 3.79% PA* |

*Net distributions are variable each month and are quoted net of management fees, costs and assume no reinvestment. Past performance is not a reliable indicator of future performance.

Reading this after June 2021?

Click on the link below to view the fund’s most recent performance.

The Trilogy Monthly Income Trust

The Trilogy Monthly Income Trust (Trust) is a pooled mortgage trust. It combines your money with that of other investors to finance a diverse range of property developments, secured by first registered mortgages, in residential, commercial, industrial, and retail sectors across the eastern seaboard of Australia.

To understand the types of loans that may be in the portfolio at any point in time, you can also read another recent blog article – an inside look into the loans that make up the Trilogy Monthly Income Trust’s loan portfolio as at 31 December 2020.

Source of distribution income

The distribution income (net of fees) that is provided to investors each month is derived from borrowers’ repayments, interest, fees, and income from other investment holdings.

Key features of the Trust

The Trust aims to provide investors with:

- exposure to the Australian property sector

- regular income, rather than capital growth

- a medium-to-long term investment

- portfolio diversification

- professional management; and

- active risk management.

Investors in the Trilogy Monthly Income Trust include individuals, self-managed super funds and wholesale investors across all age groups.

We recommend all investors seek professional advice from a licensed financial adviser before investing to ensure it meets your portfolio needs.

Risk

Mortgage trusts are considered a ‘growth’ asset class. This means they carry higher risk than defensive asset classes, with the opportunity to generate more competitive returns.

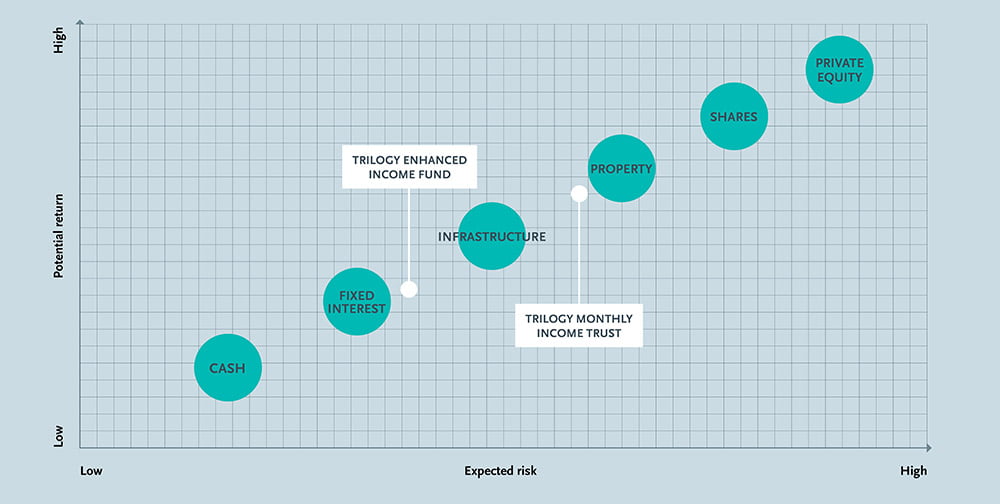

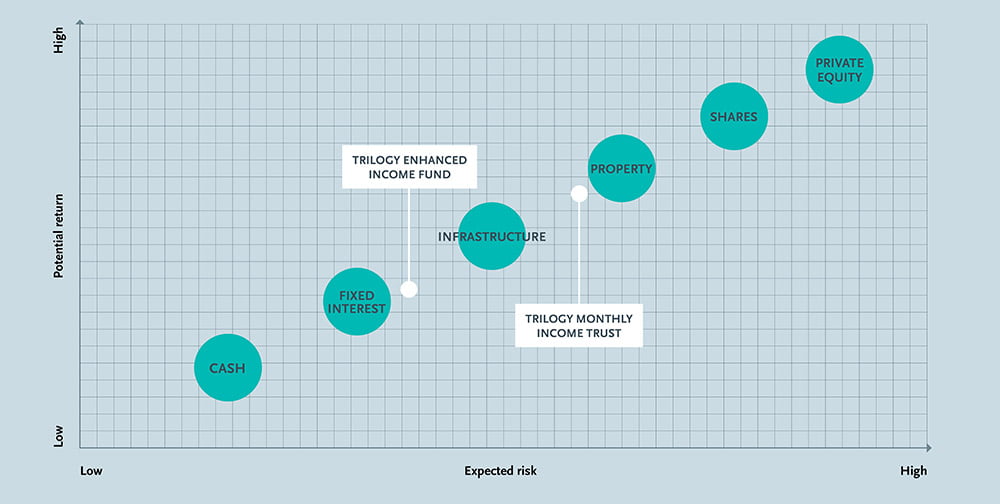

The image above is for informative purposes only and is not to be taken as definitive representation of the actual risk and return that each of these products may offer.

The Trilogy Monthly Income Trust is exposed to property market and construction risks, such as borrower default, in addition to general investment risks and specific risks of investing in a managed fund.

However, these risks are managed through dedicated portfolio managers and a vast network of property professionals, including valuers, quality surveyors and engineers who actively manage projects to ensure they’re on track.

Liquidity

Due to the nature of the product, mortgage trusts are generally considered to have low liquidity. If you invest in the Trilogy Monthly Income Trust, you should be prepared to hold your investment for a minimum of six months. This includes a minimum investment period of two months, and four-month withdrawal notice. However, withdrawals may be processed and paid in a shorter time at our discretion.

The Trust’s Performance

As at 31 May 2021, the Trust has delivered the below historical average net distribution rates.

| May 2021 distribution rate | 1 year | 5 years | Since inception in 2007 |

| 5.52% PA* | 6.35% PA* | 7.38% PA* | 7.67% PA* |

*Net distributions are variable each month and are quoted net of management fees, costs and assume no reinvestment. Past performance is not a reliable indicator of future performance.

Reading this after June 2021?

Click on the link below to view the trust’s most recent performance.

Here’s a quick investment overview of both products

| Trilogy Monthly Income Trust | Trilogy Enhanced Income Fund | |

| Fund type | Unlisted pooled mortgage trust | Unlisted diversified income fund |

| Investment strategy | To source loans, secured by registered first mortgages held over Australian property, that generate monthly income. | To invest directly and indirectly in a portfolio of cash, cash-style investments and other financial assets with returns enhanced via exposure to the pooled mortgage portfolio of the Trilogy Monthly Income Trust. |

| Minimum investment | $10,000 | $5,000 |

| Unit price | Fixed at $1.00* | Fixed at $1.00* |

| Distributions | Aims to pay monthly | Aims to pay monthly |

| Withdrawals | Four months; see PDS for details | Four months; see PDS for details |

*While fixed unit price, capital losses can still occur.

Important things to note

As with all investments, there are risks as well as potential rewards associated with investing in a mortgage trust or diversified income fund.

A licensed financial adviser can help you better understand the key features of different investment types to consider. We always recommend investors obtain, read and understand the relevant offer documents and seek advice from a licensed financial adviser before investing. The above information is provided as general product information only and does not take into account individuals’ circumstances.

Want to learn more about Trilogy’s investment options?

This article is issued by Trilogy Funds Management Limited ACN 080 383 679 AFSL 261425 (Trilogy) as responsible entity for the Trilogy Monthly Income Trust (Trust) ARSN 121 846 722 and the Trilogy Enhanced Income Fund (Fund) ARSN 614 682 469. Application for investment can only be made on the application form accompanying the Product Disclosure Statement (PDS) dated 17 December 2018 for the Trilogy Monthly Income Trust ARSN 121 846 722 and 28 July 2020 for the Trilogy Enhanced Income Fund ARSN 614 682 469 available at www.trilogyfunds.com.au. The PDS contains full details of the terms and conditions of investment and should be read in full, particularly the risk section, prior to lodging any application or making a further investment. All investments, including those with Trilogy, involve risk which can lead to loss of part or all of your capital or diminished returns. Trilogy is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed financial adviser. Investments with Trilogy are not bank deposits and are not government guaranteed.