We hope you enjoyed your information pack and bottle of Moët.

Trilogy is one of Australia’s leading fund managers of property-based investments, with a successful track record of generating income and creating wealth for our investors.

We are renowned for the exceptional, personalised service we provide to our advisers and the performance of our products*.

Compelling income options for your clients

How do the Trilogy Monthly Income Trust and Trilogy Enhanced Income Fund deliver income and portfolio diversity for clients?

Trilogy Monthly Income Trust

The Trilogy Monthly Income Trust provides investors with exposure to returns available through loans secured by first mortgages over Australian property.

The Trust’s loan pool consists of lending to the residential, commercial, industrial, and retail property sectors in Australia. For more than 13 years, our managed funds, raised by our investors, have enabled the successful completion of projects along the eastern seaboard of Australia.

Trilogy Enhanced Income Fund

Enhanced return, and access to your money within 30 days with the Trilogy Enhanced Income Fund.

Invest in a portfolio of cash, cash-style investments and other financial assets, with returns enhanced by an investment in the Trilogy Monthly Income Trust. For more than three years, the Fund has provided competitive returns to investors since its inception in 2017*.

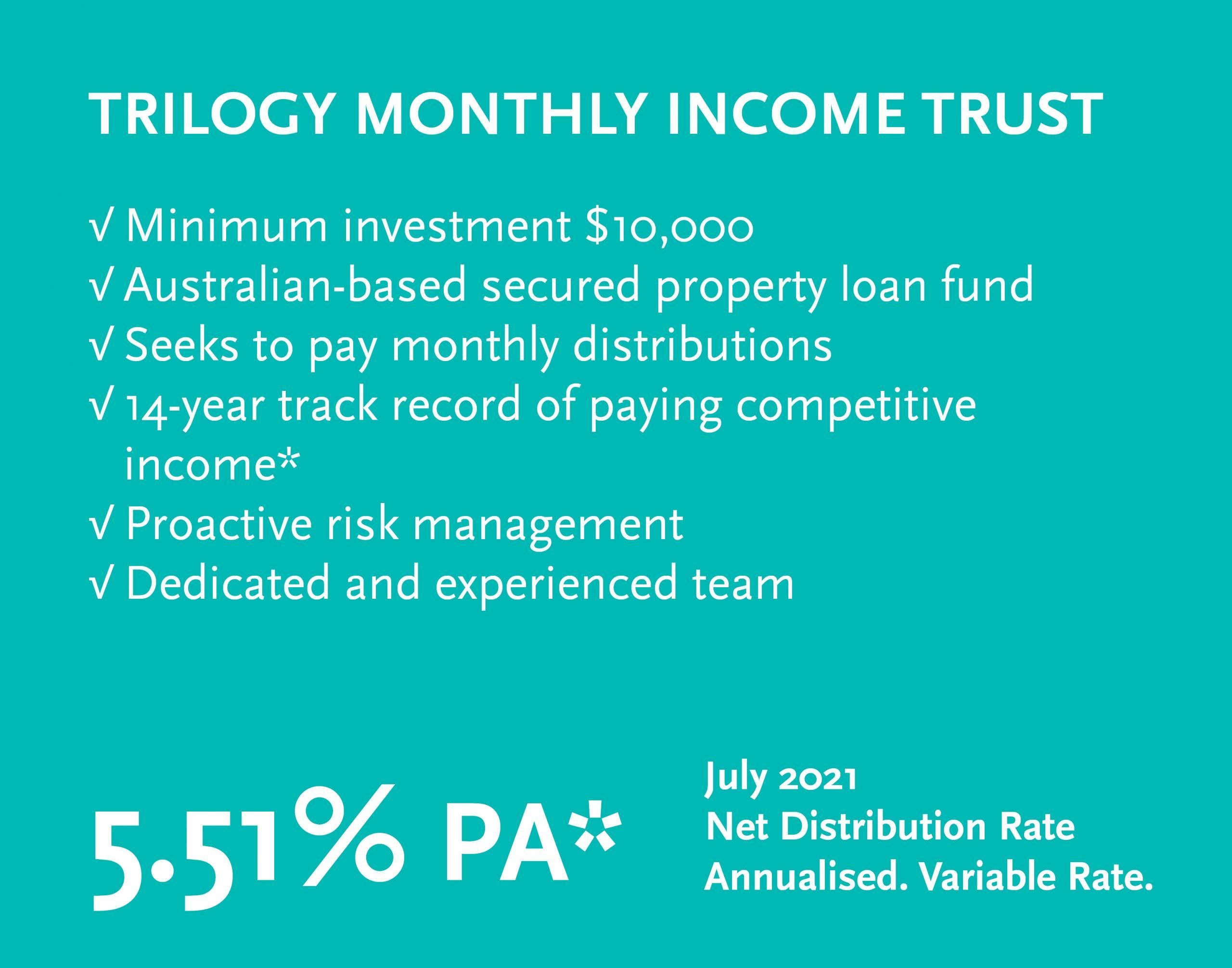

Trilogy Monthly Income Trust

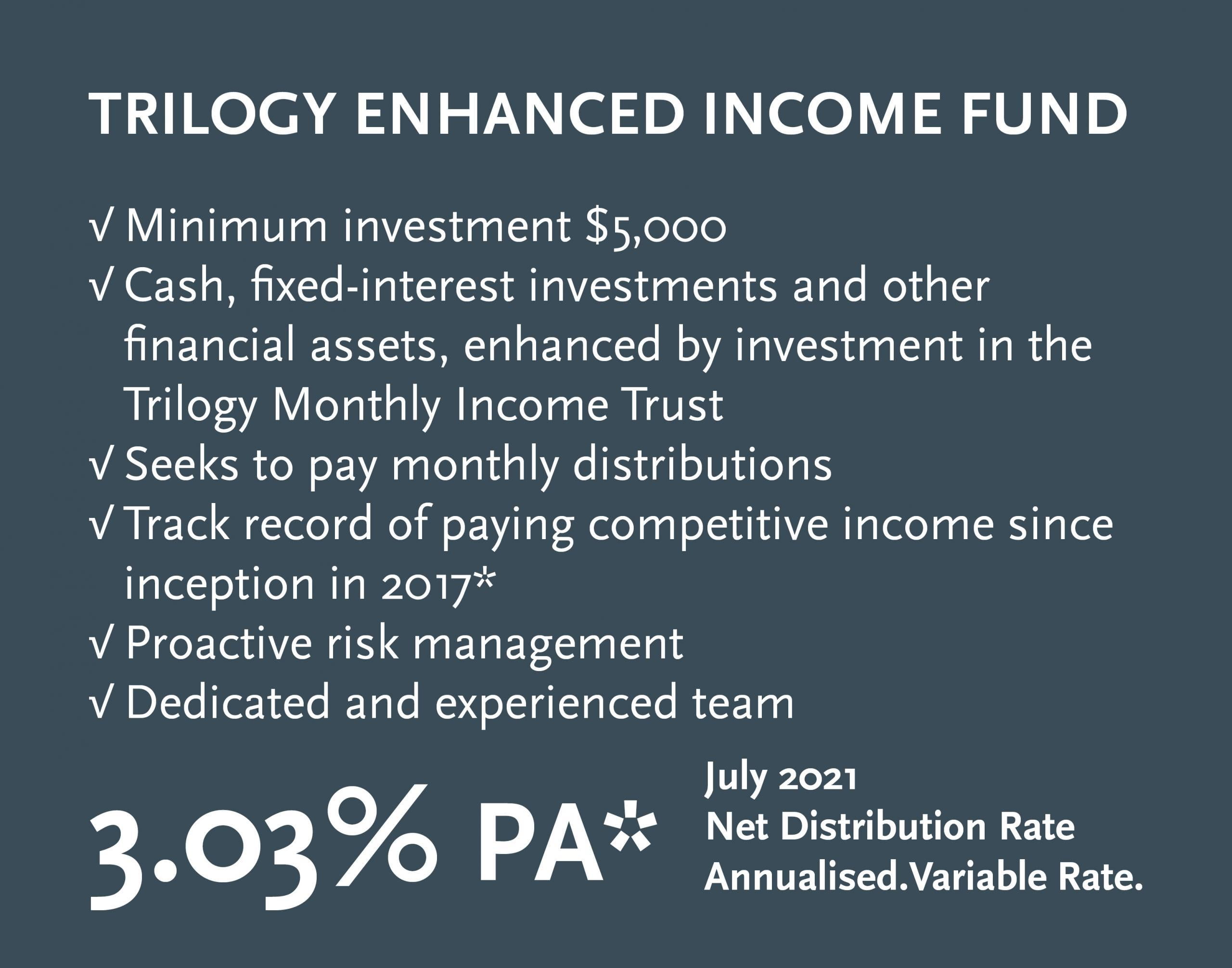

Trilogy Enhanced Income Fund

Supporting financial advisers

Trilogy has a dedicated Distribution team for Financial Advisers, we’re here to support you and your clients. We have developed a range of resources available for you.

Our products are available on the following platforms:

- Netwealth

- Hub24

- Powerwrap

- Mason Stevens

- uXchange

- OneVue

- Australian Money Market

Also available for direct investment

Get in touch with our team

Nicole Ott

National Adviser Services Manager

m 0432 105 114

e n.ott@trilogyfunds.com.au

Walter Raspopin

Business Development Manager

m 0427 355 909

e w.raspopin@trilogyfunds.com.au

Brett Scanlan

Business Development Manager

m 0403 711 524

e b.scallan@trilogyfunds.com.au

*Net distributions are variable each month and are quoted net of management fees, costs and assume no reinvestment. Distributions are calculated daily and paid monthly in arrears. Please note, past performance is not a reliable indicator of future performance.

Trilogy Enhanced Income Fund (Fund) ARSN 614 682 469 is a registered managed investment scheme of which Trilogy Funds Management Limited (Trilogy) ABN 59 080 383 is the responsible entity and issue of units and is offered under a Product Disclosure Statement (PDS) dated 28 July 2020 and available via the download button above. Trilogy Monthly Income Trust (Trust) ARSN 121 846 722 is a registered managed investment scheme of which Trilogy is the responsible entity and issuer of units and is offered under the PDS dated 17 December 2018, available via the download button above.

1 & 2 SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. Information contained in this document attributable to SQM Research must not be used to make an investment decision. The SQM Research rating is valid at the time the report was issued, however it may change at any time. While the information contained in the rating is believed to be reliable, its completeness and accuracy is not guaranteed. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

3 & 4 The information contained in the Australia Ratings Analytics report and encapsulated in the investment rating is of a general nature only. The report and rating reflect the opinion of Australia Ratings Analytics Pty Limited (AFSL 494552). It does not take into account an individual’s objectives, financial situation, or needs. Professional advice should be sought before making an investment decision. A fee has been paid by the fund manager for the production of the report and investment rating.