Trilogy’s expert Lending team proactively sources loans secured by first mortgages held over Australian property.

The performance of each construction loan funded by Trilogy underpins the returns provided to investors in our pooled mortgage fund, the Trilogy Monthly Income Trust (Trust).

As at 30 September 2020, the Trust’s funds under management (FUM) were approximately $401 million. Investor inflows for the Trust remained positive during September, providing additional funding to increase the size and diversity of the loan portfolio.

Below, we take an inside look into the loans that make up the Trilogy Monthly Income Trust’s portfolio.

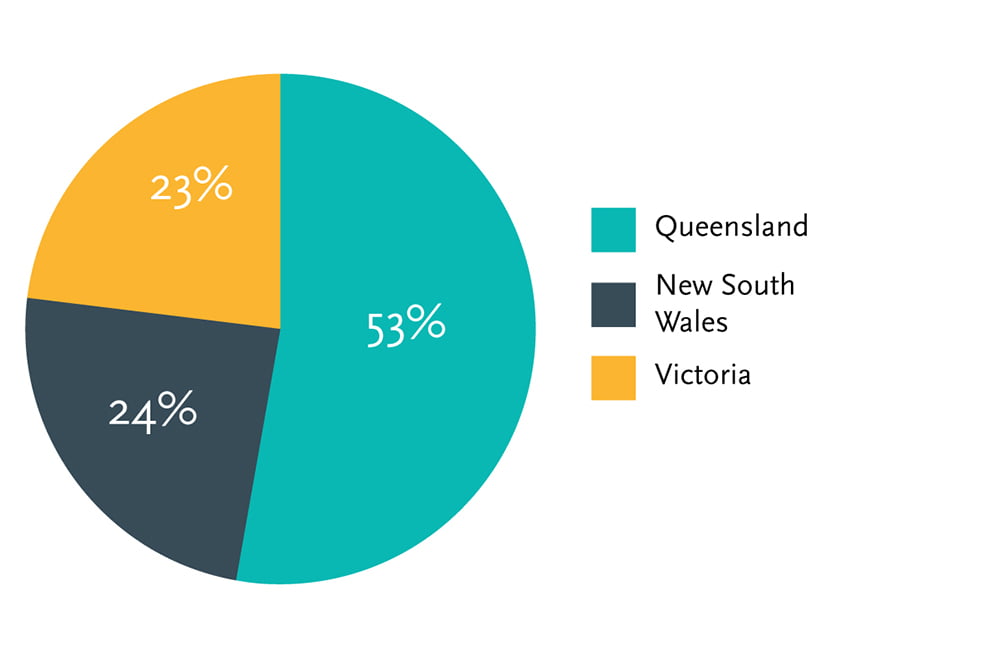

Geographic spread

The Trust’s loan book currently consists of 84 construction loans secured across Australia’s eastern seaboard, with an average weighted Loan to Valuation Ratio (LVR) of 62.71%. Queensland represents 53% of the loans, with 24% in New South Wales and 23% in Melbourne*.

Loan diversification

Residential construction currently makes up 53% of Trilogy’s current loan book, followed by land development (29%), completed residential (12%), completed commercial/industrial (4%) and commercial/industrial construction (3%).

September Performance

Three loans were fully repaid in September. Two new loans were also settled in September, one in Brisbane for an approved amount of $2.8 million with a repeat borrower for a further stage of a highly successful land subdivision, and another in Sydney for an approved amount of $7.25 million, with a new borrower for an eight-townhouse development. The Trust continues to perform well with borrowers generally progressing their projects in forecast timelines.

We are continually reviewing new loan requests, considered through our comprehensive review process by our experienced Lending team and Lending Committee members.

Seeking a property development finance solution?

Discuss your construction loan needs with one of our dedicated portfolio managers on 1800 230 099 or by email lending@trilogyfunds.com.au.

Learn more about the Trilogy Monthly Income Trust >

*All figures are based on unaudited figures as at 30 September 2020 and may be subject to change. Past performance is not a reliable indicator of future performance. Please note figures have been rounded to the nearest percent.

This article has been prepared by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425. Trilogy is not a licensed credit provider and does not make loans regulated by the National Credit Code. The source of Trilogy’s loans may include managed investments schemes registered with ASIC, as well as other private lending arrangements with high net worth investors.