Trilogy Industrial Property Trust

Award Winning Property Trust

Key fund details

March 2024 total return | 7.52%* Unit Price (1 April 2024) | $1.1251** No. of properties | 15****

WALE | 5.82 years (by income)*** Fund size | $253.73m*** Trust LVR | 45.00%***

Distribution frequency | Monthly^^ Tax deferred | 89.42%^^^ Historical Unit Price & CPU | View data

November 2022 distribution | 7.57 CPU p.a.*

Unit Price (1 November 2022) | $1.1035**

No. of properties | 15****

Unit Price (1 December 2022) | $1.0994^

WALE | 5.09 years (by income)***

Fund size | $207.33m***

Distribution frequency | Monthly^^

Trust LVR | 47.37%***

Tax deferred | 56.50%^^^

Historical Unit Price & CPU | View data

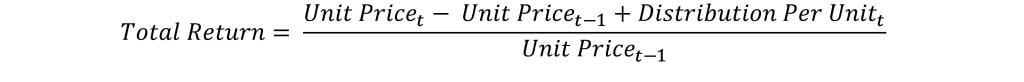

Total return

| 1 Month (%) | 6 Months (%) | 1 Year (%) | 3 Years (% P.A) | Since Launch (% P.A)1 | |

| Income | 0.59 | 3.57 | 7.13 | 7.11 | 7.63 |

| Growth | (0.20) | 0.86 | 0.39 | 3.48 | 2.03 |

| TOTAL | 0.39 | 4.43 | 7.52 | 10.59 | 9.66 |

1Actual total return delivered to investors for the 12 months to 31 March 2024. Distributions are variable each month, net of management fees, costs and assume no reinvestment. Distributions are paid monthly in arrears. Please note, past performance is not a reliable indicator of future performance.

**Unaudited Unit Price as at 1 April 2024. Variable price and may change each month.

***As at 31 March 2024.

****As at 31 March 2024.

^^Subject to terms in the Product Disclosure Statement (PDS).

^^^Audited figure as at 30 June 2023.

Request an information pack

Learn more about Trilogy Funds and investing in the Trilogy Industrial Property Fund.

The pack includes more detailed information and key documents about the Fund.

Property portfolio

Property Portfolio

The Trilogy Industrial Property Trust currently holds 15 industrial properties across Queensland, New South Wales, Victoria, South Australia, and the Northern Territory. Explore further property details in our investment brochure.

Berrimah, Northern Territory

The property is strategically positioned between the Darwin and Palmerston population centres, and close to the East Arm port district. The main entry to the car park can be accessed by vehicles arriving from Darwin or Palmerston.

The building was constructed in 2018, boasting a 125 metre frontage to the Stuart Highway and 260 car parks. The property is a combination of a showroom and warehouse.

Martin Drive, Tomago, New South Wales

The property is located approximately 19 kilometres northwest of Newcastle’s CBD, and seven kilometres east of the M1 Motorway. The property also has clear access to the Pacific Highway and the Pacific Motorway.

The industrial facility is erected over two non-contiguous allotments. The first allotment comprises four buildings, including three workshops, one warehouse and two-level offices. The second allotment comprises a single warehouse with ancillary office space.

Ron Parkinson Crescent, Corbould Park, Queensland

The property is located in the Sunshine Coast Industrial Park, the region’s largest industrial estate. Facilities include two levels of office and amenities at the front of the building with a large warehouse at the rear. The property has four gantry cranes and two street frontages.

Carrington Road, Torrington, Queensland

The property consists of eight buildings including a street front showroom and seven metal-clad buildings for sales and repairs. The property is located within Toowoomba’s industrial precinct and is well positioned to capitalise on the expanding Toowoomba Trade Gateway.

Magnesium Street, Narangba, Queensland

The property is located in the Narangba Innovation Precinct within the Moreton Bay Regional Council area part of the greater Brisbane region. The property contains two industrial buildings, both providing warehouse and office accommodation with gantry crane amenities. The complex has a wide frontage to the road with three crossover points, secure access, driveway and car parking areas.

Galleghan Street, Hexham, New South Wales

The property is a modern, freestanding warehouse facility split into two tenancies, incorporating ambient warehousing, cool room facilities and office accommodation with access points located along each elevation. It is located approximately 14km northwest of the Newcastle CBD, and 7km east of the M1 Motorway. The property is currently tenanted by ASX-listed company, Bega Cheese Limited and subsidiary of an ASX-listed company, Downer EDI Engineering Power Pty Ltd.

Dacmar Road, Coolum Beach, Queensland

The property is located in the Centra Park Industrial Estate 3 kilometres west of the Coolum Town Centre and 1 kilometre from the Sunshine Coast Motorway. The asset comprises two modern industrial warehouses and distribution facilities and adjoining office with ancillary improvements of concrete hardstand. Currently tenanted by Weir Minerals Australia Limited.

Moorebank Road, Wellcamp, Queensland

A large industrial landholding improved with an office and warehouse building completed in 2020 and currently tenanted by Australian Coil Services Pty Ltd. The property is located within the Charlton Wellcamp Enterprise area, approximately 12km from Toowoomba town centre and 12km to Wellcamp airport.

Colemans Road, Carrum Downs, Victoria

A modern warehouse and office complex constructed in 2016. The property includes 6 loading dock bays and 55 car parking bays and is leased to Tempur Australia Pty Ltd. After acquiring the property, Trilogy negotiated an Agreement of Lease for the expansion alongside an extension to the existing Lease term with Tempur. This increased the WALE of the asset by two years, and created a viable project for the Trust to undertake that would benefit Tempur and TIPT investors.

Click to read more about the expansion in Carrum Downs, VIC.

Diesel Drive, Mackay, Queensland

A modern, high-specification industrial building with 16 metre clearance and two gantry cranes. The property was purpose built in 2014 for the current tenant, Independent Mining Services QLD Pty Ltd. In 2019, Trilogy completed construction on a value-add extension which added an additional 900 square metres (approximately) of net lettable area.

Bedford Street, Gillman, South Australia

A property completed in 2018 comprising two industrial units and two tenancies, occupied by Tyremax Pty Ltd (Tyremax) and Plasdene Glass-Pak Pty Ltd (Plasdene).

Bosso Street, Mackay, Queensland

19-29 Bosso Street is a purpose-built office, warehouse, workshop and track press facility. The property also features a modern concrete tilt panel facility. This site is leased to Komatsu Australia Pty Ltd (Komatsu) and is its main Mackay Customer Support facility, offering sales, track repairs, service and parts.

The adjoining property, 15-17 Bosso Street, comprises land and is leased to Komatsu for storage of plant machinery.

Elysium Road, Carrara, Queensland

Modern office facility and industrial premises, the property comprises multiple freestanding structures including the administration building and multiple workshops. The property is leased to Mineral Technologies Pty Ltd, a subsidiary of top 100 ASX listed parent company Downer EDI Limited.

Gravel Pit Road, Darra, Queensland

Located in one of Brisbane’s core industrial precincts, this property is a modern industrial facility currently tenanted by Stoddart Group. The Darra precinct, just 17.6 kilometres south west from the Brisbane CBD, is also expected to benefit from the $80 million Sumners Road Interchange Upgrade, delivering further road network benefits.

Trust updates

Important updates regarding the Trilogy Industrial Property Trust can be found here. Please check this section regularly to ensure you are aware of important updates and changes relating to the Trust. Should you have any questions, please feel free to contact our Investor Relations team on 1800 230 099 or by emailing investorrelations@trilogyfunds.com.au

| Date | Document | Type |

| 01.03.2024 | 2024 INTERIM WITHDRAWAL OFFER | The 2024 Interim Withdrawal Offer period is now closed. Applications closed at 5pm (AEST) Thursday 29 February 2024. Full details relating to the offer can be found here | Investor update |

| 11.09.2023 | NEW PDS, TMD AND RG46 | Investor update |

| 28.02.2023 | NEW RG46 | Investor update |

| 14.12.2022 | STUART HIGHWAY, BERRIMAH, NORTHERN TERRITORY | Settlement of Stuart Highway, Berrimah, Northern Territory occurred on Wednesday 14 December 2022. | Acquisition |

| 02.12.2022 | STUART HIGHWAY, BERRIMAH, NORTHERN TERRITORY | A contract was signed for a new property to add to the Trust in Berrimah, Northern Territory on Friday 2 December 2022. | Investor update |

| 30.09.2022 | NEW PRODUCT DISCLOSURE STATEMENT | Investor Update |

| 30.09.2022 | NEW RG46 | Investor Update |

| 30.09.2022 | New TMD; Click here for historical TMD | Investor Update |

| 12.09.2022 | MARTIN DRIVE, TOMAGO, NEW SOUTH WALES | Settlement of Martin Drive, Tomago, New South Wales occurred on Monday 12 September 2022. | Acquisition |

| 05.09.2022 | MARTIN DRIVE, TOMAGO, NEW SOUTH WALES | A contract was signed for a new property to add to the Trust in Tomago, New South Wales on Monday 5 September 2022. | Investor update |

| 26.07.2022 | Supplementary product disclosure statement – july 2022 | Investor Update |

| 30.06.2022 | ANNUAL REPORT | Investor Update |

| 10.06.2022 | RON PARKINSON CRESCENT, CORBOULD PARK, QUEENSLAND | Settlement of Ron Parkinson Crescent, Corbould Park, Queensland occurred on Friday 10 June 2022. | Acquisition |

| 26.05.2022 | RON PARKINSON CRESCENT, CORBOULD PARK, QUEENSLAND | A contract was signed for a new property to add to the Trust in Corbould Park, Queensland on Thursday 26 May 2022. | Investor update |

| 12.04.2022 | CARRINGTON ROAD, TORRINGTON, QUEENSLAND | Settlement of Carrington Road, Torrington, Queensland occurred on Monday 11 April 2022. | Acquisition |

| 12.04.2022 | COLEMANS ROAD, CARRUM DOWNS, VICTORIA | A 550 square metre extension to the existing warehouse at the Carrum Downs property will be constructed to support the tenant, Tempur Australia, with product expansion. The construction project will commence in coming months and is due for completion in August 2022. | Property update |

| 17.03.2022 | CARRINGTON ROAD, TORRINGTON, QUEENSLAND | A contract was signed for a new property to add to the Trust in Torrington, Queensland on Thursday 17 March 2022. | Investor update |

| 02.02.2022 | 2022 Withdrawal offer | The 2022Withdrawal Offer period is now closed. Withdrawal applications must be received no later than 5pm (AEST), Tuesday 1 March 2022. Please ensure you read the Withdrawal Offer document for full details. | Investor Update |

| 02.02.2022 | PDS Update – February 2022 | Investor Update |

| 02.02.2022 | 2022 withdrawal offer frequently asked questions | Investor Update |

| 09.12.2021 | MAGNESIUM STREET, NARANGBA, QUEENSLAND | Settlement of Magnesium Street, Narangba, Queensland occurred on Thursday 9 December 2021. | Acquisition |

| 09.11.2021 | MAGNESIUM STREET, NARANGBA, QUEENSLAND | A contract was signed for a new property to add to the Trust in Narangba, Queensland on Tuesday 9 November 2021. | Investor update |

| 14.10.2021 | GALLEGHAN STREET, HEXHAM, NEW SOUTH WALES | Settlement of Galleghan Street, Hexham, New South Wales occurred on Thursday 14 October 2021. | Acquisition |

| 01.10.2021 | Target MARKET DETERMINATION (TMD) | Investor Update |

| 24.09.2021 | GALLEGHAN STREET, HEXHAM, NEW SOUTH WALES | A contract was signed for a new property to add to the Trust in Hexham, New South Wales on Friday 24 September 2021. | Investor update |

| 31.08.2021 | DACMAR ROAD, COOLUM BEACH, QUEENSLAND | Settlement of Dacmar Road, Coolum Beach, Queensland occurred on Tuesday 31 August 2021. | Acquisition |

| 02.08.2021 | PUBLICATION OF UNIT PRICE & DISTRIBUTION RATES | Unit price and distribution rates will be published on the website on or around the 7th business day of each month.

Investors who submitted completed applications (including receipt of cleared funds in the Trust’s account) by 4.00 pm on the last business day of the previous month will receive confirmation of units issued via their preferred communication method on or around the 9th business day of each month. In line with the PDS, distributions are paid on or around the 8th business day for investors. |

Investor update |

| 30.07.2021 | MOOREBANK ROAD, WELLCAMP, QUEENSLAND | Settlement of Moorebank Road, Wellcamp, Queensland occurred on Friday 30 July 2021. | Acquisition |

| 29.07.2021 | DACMAR ROAD, COOLUM BEACH, QUEENSLAND | A contract was signed for a new property to add to the Trust in Coolum, Queensland on Thursday 29 July 2021. | Investor update |

| 09.07.2021 | Moorebank Road, Wellcamp, Queensland | A contract was signed for a new property to add to the Trust in Wellcamp, Queensland on Friday 9 July 2021. | Investor update |

| 01.07.2021 | PRODUCT DISCLOSURE STATEMENT | Investor update |

| 30.06.2021 | Annual report | Investor update |

| 28.06.2021 | COLEMANS ROAD, CARRUM DOWNS, VICTORIA | Settlement of Colemans Road, Carrum Downs, Victoria occurred on Monday 28 June 2021. | Acquisition |

| 31.05.2021 | RG46 | Investor update |

| 16.10.2020 | GRAVEL PIT ROAD, DARRA, QUEENSLAND | Gravel Pit Road, Darra is part of the Trilogy Industrial Property Trust (Trust) portfolio occurred on Friday, 16 October 2020. | Acquisition |

| 9.10.2020 | Closed for Investment | Within two weeks of opening for investment, we are pleased to announce that the Trust has reached full subscription of $18.155m and is now closed for investment. | Investor update |

| 25.09.2020 | Open for investment | The trust is now open for investment. $18.155 M offer amount. | Investor update |

| 30.06.2020 | Annual Report | Investor update |

How an Unlisted Property Trust works

In this short video we step you through how an Unlisted Property Trust works.

Click on the play icon to start the video.

NEW PROPERTY ACQUISTION

The Trust recently acquired its 16th property in Berrimah, Northern Territory

The acquisition provides key geographic diversity to the Trust.

It also has a strong tenant covenant, leased to four national blue-chip tenants with long-term leases.

The property’s weighted average lease expiry (WALE) is approximately nine years, improving the WALE of the Trust overall.

Investment overview

Investment objective

The Trust is designed to build a diverse portfolio of industrial properties located in established regional and metropolitan precincts. The Trust’s primary objective is to maximise potential investor returns diversified by both geographical location and the industries in which the tenants operate.

Property type

Industrial assets such as warehouses and manufacturing, logistics and distribution centres.

Property location

Australian industrial precincts in established regional cities and metropolitan areas of capital cities

Leases

Leases expected to provide a stable income stream.

Management

Active management style encompassing the opportunity for renegotiation of lease terms and facilitating potential tenant-led expansion.

Expansion opportunities

Where possible, the Trust intends to invest in properties that provide the potential for value-add. This could include tenant-led expansion, refurbishment, or improvement works. The Trust will also consider development opportunities, bringing fresh stock to the portfolio and enabling the Trust to secure long-term leases with new tenants.

Click to learn more about our most recent expansions in Carrum Downs and Mackay.

Rated ‘Very Strong’ in Foresight Analytics 2021 research report1

1The information contained in the Foresight Analytics report and encapsulated in the investment rating is of a general nature only. The report and rating reflect the opinion of Foresight Analytics and Ratings Pty Limited (AFSL 494552). It does not take into account an individual’s objectives, financial situation, or needs. Professional advice should be sought before making an investment decision. A fee has been paid by the fund manager for the production of the report and investment rating.

Request an information pack

Learn more about Trilogy Funds and investing in the Trilogy Industrial Property Trust.

The pack includes more detailed information and key documents about the Fund.