As an investor, regularly reviewing your investment portfolio to ensure it suits your financial goals, personal circumstances, and tolerance for risk, is imperative. With the significant economic changes that occurred over the past financial year, there’s no better time to review your portfolio.

Earlier this year, we shared our top five tips for your new financial year investment portfolio review. After reviewing your personal financial situation, financial goals, investment strategy and asset allocation, you may find yourself needing to adjust your asset allocation to suit your current needs.

If you’re looking to add portfolio diversity and income to your investment portfolio, read on as we discuss three options.

1. Mortgage Trusts

For those seeking a professionally managed investment offering competitive income and indirect exposure to the property sector, a mortgage trust (also known as a mortgage fund) might be the investment option for you.

A mortgage trust is an investment vehicle that lends investor money to commercial borrowers to finance land subdivision, property development or construction. These loans are generally secured by mortgages over property as the primary security.

They aim to generate a regular and competitive income for investors via loan repayments, interest and fees paid by the borrowers, as well as income from cash and other underlying investments held by the trust.

The Trilogy Monthly Income Trust

One option to consider is the Trilogy Monthly Income Trust (Trust), a pooled mortgage trust which provides you with exposure to returns available through more than 100 loans secured by first registered mortgages over Australian residential, commercial, industrial, and retail property.

Why include the Trilogy Monthly Income Trust in your portfolio?

- Professional management

- Competitive income returns

- Monthly distributions*

- Income derived from Australian property development & construction loans secured by registered first mortgages

- 100+ loans diversified by location, development type & project stage

- Medium-to-long term investment

- Adds diversification to your broader investment portfolio

* Subject to terms in the PDS

2. Diversified Income Funds

If you’re seeking a professionally managed investment offering regular income and access to your money in shorter time frames, a diversified income fund might be an investment option for you.

Diversified income funds invest in a range of cash, fixed-interest investments and other financial assets. Through these investments, diversified income funds aim to generate returns that are higher than a general market rate, such as the official cash rate set by the Reserve Bank of Australia.

Depending on the fund or fund manager, they may seek to further enhance the returns offered by the fund by investing a portion of the fund’s money in other investments including equities, Exchange Traded Funds or property-based investments.

The Trilogy Enhanced Income Fund

The Trilogy Enhanced Income Fund (Fund) is a diversified income investment option which aims to provide you with a regular income from the fixed interest and property asset classes.

When you invest in Trilogy Enhanced Income Fund, approximately 65% of your funds are invested in cash, cash style assets and other financial assets. These may include a range of short to medium term bank deposits, bills of exchange, promissory notes, bonds, fixed or floating rate debt securities and income securities. These investments generally belong to the fixed interest asset class.

To enhance returns, the remainder of the portfolio is invested in the Trilogy Monthly Income Trust, which, as outlined above, seeks income from indirect property investment.

Why include the Trilogy Enhanced Income Fund in your portfolio?

- Competitive income returns

- Monthly distributions*

- Access to your money in 30 days*

- Access to ‘best of breed’ fixed-interest investments

- Returns enhanced by exposure to the Trilogy Monthly Income Trust

- Dedicated and experienced in-house Investment team

- Adds diversification to your broader investment portfolio

* Subject to terms in the PDS

3. Property Trusts

If you’re seeking a professionally managed investment offering competitive income, direct exposure to the property sector, the opportunity for capital growth and a tax-effective investment, a property trust might be an investment option for you.

Property trusts purchase a property asset or range of assets in the residential, industrial, commercial, tourism and/or retail property sectors with the aim of generating regular income for investors via rental income from the property or properties’ tenants, and the potential for capital growth when the asset is sold.

Property trusts are considered long-term investments where your initial capital remains invested in the Trust and cannot be withdrawn until the property or properties are sold or a withdrawal offer is made by the Responsible Entity. Withdrawal timelines may vary between property trusts, so it is important to read the Product Disclosure Statement (PDS) before making an investment decision.

The Trilogy Industrial Property Trust

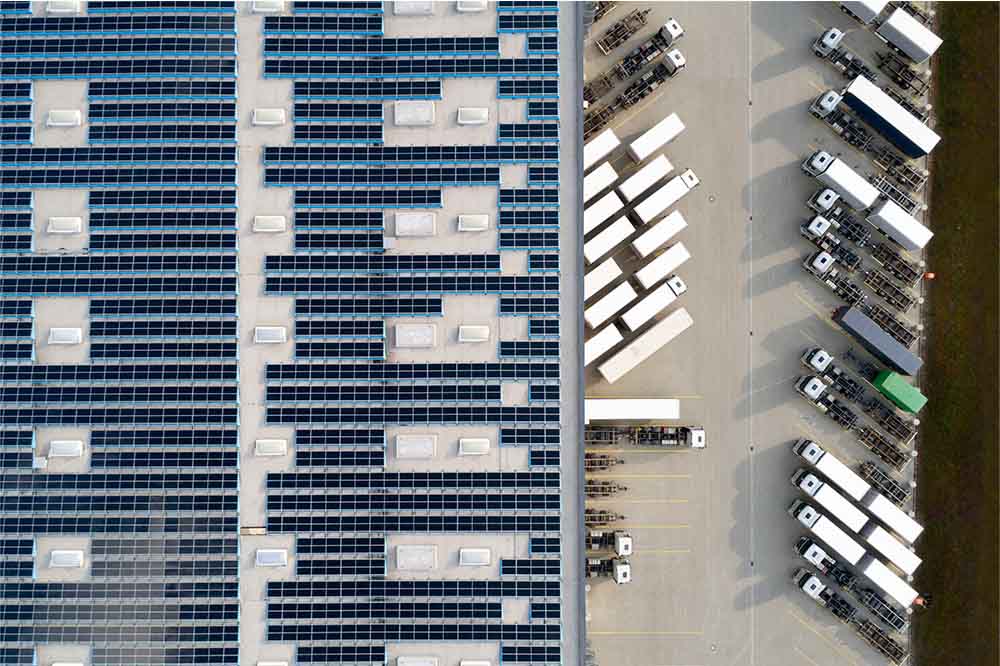

The Trilogy Industrial Property Trust (Industrial Trust) aims to build a diverse portfolio of industrial properties located in key Australian regional and metropolitan precincts.

The Industrial Trust targets industrial properties that have the potential to provide you with long-term cashflows and could offer the opportunity of value-add.

It currently holds nine assets across Queensland, Victoria and South Australia. We expect the Trust’s portfolio will continue to expand due to significant investor demand and the focus of our Property team on identifying additional high-quality acquisitions.

Why include the Trilogy Industrial Property Trust in your portfolio?

- Competitive income returns

- Monthly distributions*

- Access to the sought-after industrial property asset class

- Long leases with tenants of good covenant

- Opportunity for capital growth over the long term

- Tax-effective income opportunity

- Long-term investment

- Adds diversification to your broader investment portfolio

* Subject to terms in the PDS

This article is issued by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425 (Trilogy Funds) as responsible entity for the management investment schemes mentioned in this article. Application for investment can only be made on the application form accompanying the relevant Product Disclosure Statement (PDS) and by considering the Target Market Determination (TMD) available at www.trilogyfunds.com.au. The PDS contain full details of the terms and conditions of investment and should be read in full, particularly the risk section prior to lodging any application or making a further investment, together with the TMD. All investments, including those with Trilogy Funds, involve risk which can lead to loss of part or all of your capital or diminished returns. Trilogy Funds is licensed to provide only general financial product advice about its products and therefore recommends you seek personal advice on the suitability of this investment to your objectives, financial situation and needs from a licensed financial adviser. Investments with Trilogy are not bank deposits and are not government guaranteed.