At Trilogy Funds, we provide commercial property development finance for brokers and property developers Australia-wide. Our purpose is to go beyond traditional lenders by offering tailored, flexible and personalised solutions.

With more than 20 years of experience financing projects across the residential, commercial, industrial and retail property sectors, we know what it takes to make your project successful.

Our team is here to help you with a loan between $3 million and $40 million with funds ready to deploy via competitive rates and terms.

Why choose Trilogy Funds?

Thousands of investors continue to seek a competitive return via our pooled mortgage fund, the Trilogy Monthly Income Trust – the primary source of capital for the property development and construction loans provided by Trilogy Funds.

This means funds are readily available and we can provide indicative responses to loan applications typically within 48 hours.

With a strong belief in supporting developers with quality projects, our team focuses less on pre-sales and more on a holistic outlook, taking into account property development experience, project merit, risk mitigants, project gearing and the borrower group’s financial strength.

With a vested interest in ensuring each property project in our portfolio delivers on its financial goals, our team will work with you from loan inception through to completion, offering tailored loan support where needed.

Indicative offers typically within 48hrs

Funds readily available from pooled mortgage fund

Competitive tiered pricing model

Tailored project support by experienced team

Financing with Trilogy Funds

In this short video, we step you through our lending process and outline what you can expect when you work with Trilogy Funds.

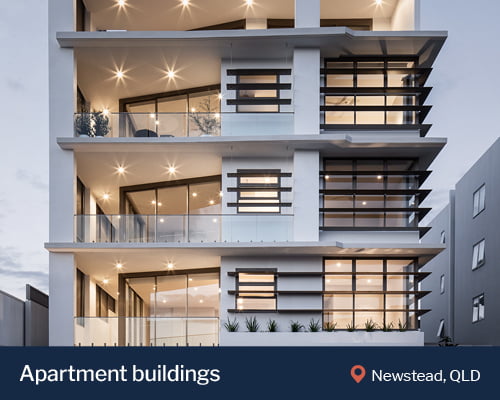

Do you have a project like this you’re seeking funding for?

We are delighted to be building wealth together with an increasing number of brokers and developers, all with different funding needs.

Whether it’s for land sub-division, property construction or completed stock, inner-city or regional, our team is available to discuss development financing for your project.

Target loan criteria

To ensure your project stacks up, consider some of our target loan criteria.

- Proven track record in property development & construction

- Loan size between $3m & $40m

- LVR no greater than 65% of the GRV

- Registered first mortgage as security

- Clear marketing strategy for sell down or refinance

For more information, view our frequently asked questions.

Tell us about your project

Hear from our clients

Loans by Trilogy Funds

As featured on

Major sponsor of The Urban Developer Awards for Industry Excellence 2021 & 2022

Award sponsor at Australian Mortgage Awards 2022

Sponsor of National Industry Conference & Gala Dinner 2022

Sponsor of SME Broker Bootcamps 2022 and Australian Broking Awards 2021

Award sponsor at Australian Mortgage Awards 2022

Learn more on the Trilogy Funds blog

Let's discuss your project

Explore property development projects financed by Trilogy Funds

Let's discuss your project

Our team

Our Lending Team will work with you to tailor a loan which best enables you to begin, progress with timely drawdowns and complete your project.

We also have staff who specialise in managing construction progress draws and processing contractor remittances and invoices, to ensure payments are made on time.

In addition, we have long-term relationships with a comprehensive network of property professionals who specialise in quantity surveying, valuing, project management, real estate agency services and more, so the necessary consultants are always on hand to assist where needed.

Brisbane, QLD

Sydney, NSW

Melbourne, VIC

Let's discuss your project

Frequently asked questions

Why should I finance my next project with Trilogy Funds?

As one of Australia’s leading non-bank lenders, our aim is to provide a competitive finance solution that is tailored to the borrower and project’s needs. Unlike some other lenders, we possess the flexibility and capacity to work closely with brokers and developers. We provide ongoing finance support from loan inception through to loan completion with a vested interest in ensuring each project delivers on its financial goals.

What types of property development projects does Trilogy Funds finance?

We provide commercial property development and construction finance for projects across the residential, commercial, industrial and retail property sectors. This covers a range of project types, including:

- Townhouses

- Apartment buildings

- Industrial complexes & parks

- Prestige houses

- Completed stock

- Land sub-divisions

- Site acquisition

- NDIS & SDA housing

- Commercial buildings

How can I secure a loan from Trilogy Funds at your lowest rate?

Premium pricing is offered to borrower groups with risk mitigants applied to the project. This generally includes a lower LVR, pre-commitments, and a clear strategy for sell down or refinance (among other factors).

Does Trilogy Funds have relationships with relevant consultants that can assist with my project?

We have long-term relationships with a comprehensive network of property professionals, who specialise in quantity surveying, project management, real estate agency services and more, so the necessary consultants are always on hand to assist where needed.

Once the loan is approved, we have staff who specialise in managing construction progress draws and processing contractor remittances and invoices to ensure payments are processed promptly to help keep projects progressing.

What is Trilogy Funds’ LVR limit?

Our target maximum LVR is 65% of the Gross Realisable Value (GRV) (incl. GST), and a maximum of 70% LVR on the “as-is” land value.

Does Trilogy Funds only finance projects if pre-sales have occurred?

No, pre-sales are not required for us to consider a loan.

What is Trilogy Funds’ typical loan term?

Our target loan term ranges from 12 months to a maximum 24 months.

Does Trilogy Funds provide home loans?

We do not provide loans to individuals seeking home loans as regulated under the National Consumer Credit Protection Act 2009. We work with brokers and direct property developer clients seeking development financing for commercial property projects only.

Does Trilogy Funds fund GST?

Yes. Subject to the borrower group being registered for GST on a monthly basis, Trilogy Funds can fund GST subject to the GST being refunded within two months (subject to certain terms and conditions). Alternatively, the borrower group can elect to pay.

Does Trilogy Funds provide loans for completed stock?

Yes, completed stock loans are available for certain projects and are assessed on a case-by-case basis.

Can’t find the answer you’re looking for?

Get in touch with our Lending Team on 1800 230 099 or email lending@trilogyfunds.com.au.